If you came here looking for a Stripe payment solution for WordPress, chances are it’s for one thing and one thing only.

You want to get paid.

This article will help you get paid, so hang tight. The types of payments you want to receive do have an impact on which Stripe payment solutions I’ll recommend.

So let’s dive into the specifics, shall we?

Stripe Rocks, Here’s Why

You probably already know that Stripe is a great payment gateway, otherwise, you wouldn’t be looking for a WordPress Stripe integration.

But did you know that Stripe offers some very competitive fees, especially when you compare it with the ubiquitous PayPal? Yep, Stripe’s fees have not increased (at least at the time of publishing) and that means you’re only paying 30 cents per transaction and 2.9% of the sale.

That means you get to keep more of the money you do make.

For a full Stripe vs. PayPal comparison click here, and you’ll find out which is the best payment gateway for you.

Stripe is also awesome because it was designed to be developer-friendly. Now that doesn’t mean that you need to be a developer to use Stripe, but rather that people who develop shopping carts and checkout form software can do cool stuff with Stripe.

You can accept credit card payments and also handle things like 3D secure checkout.

The Stripe payment gateway also integrates with things like Apple Pay, Google Pay, and other local options like payments from a bank account.

Do You Really Need a Stripe WordPress Plugin?

Did you know that Stripe has their own order forms and that you don’t need to use a plugin at all? Go ahead and log in to your Stripe account settings area to check it out now. I’ll wait.

With the Stripe checkout pages, you can collect billing and shipping address, and also process payments in test mode to make sure everything is working.

The stripe checkout forms are pretty snazzy, but before you close this blog post let’s talk about why you may still want to use a plugin on your WordPress site to take payments via Stripe.

That’s because there’s usually more that happens than just taking someone’s money and disappearing into the night.

You need to deliver something for these credit card payments.

That’s where using a WordPress Stripe plugin really comes in, because you can integrate with your other systems and handle everything more smoothly.

There are a few popular Stripe WordPress plugins on the market like:

- Simple Pay plugin

- WooCommerce Stripe payment gateway

- Easy Digital Downloads

These are simple WordPress Stripe plugins that allow you to take Stripe payments on your WordPress website. The WooCommerce plugin is a good option for an online store where you need to be able to accept payments online on an assortment of WordPress websites.

But if you want to kick things up a notch, keep reading.

What Happens After You Take These Stripe Payments

If you need to deliver a service or a product, you need an easy way to do that after online payments come through.

On top of that, if you’re offering recurring payments you need to be able to deliver something on a recurring basis too. That goes for both digital and physical products, and services, too.

Let’s look at some of these options:

Delivering Digital Products

When it comes to selling digital products, like a downloadable MP3 or PDF document, it’s pretty straightforward with Stripe payments.

You can create a page on your website where the download lives, and people can be sent the link in a welcome email or shown this page after their purchase.

It’s pretty easy to set up, and there’s not much that can go wrong.

The problems arise if you want to protect your digital products, so people don’t share them with those who didn’t purchase them themselves.

One way to get around the sharing of copyrighted materials is to add a watermark that includes the name of the person who made the original purchase.

That way, if a stolen copy of your digital product finds itself on a sharing site, you can trace it back to the person who leaked the file.

Another way that using a watermark helps to protect your work is that it will also deter people from sharing in the first place.

Selling Online Courses

Now let’s kick things up a notch and look at selling online courses with Stripe.

After a successful payment, you could deliver an online course the same way that you do for smaller digital products: via email or on a web page.

However, it becomes harder to stop people from sharing an online course because it’s often a video or a series of content that cannot be watermarked as easily.

That’s where having a protected members-only area of your website comes in.

After you take payment via Stripe, you can create a username and password for the customer and deliver the online course that way.

From there, your members-only site can detect if people are sharing the same account and limit concurrent logins.

An added benefit of using a portal website to house your online courses is that you can personalize the online learning experience.

You can also do cool things like tracking your students’ progress, and even upselling or cross-selling other courses and products based on their actions.

Plus you can deliver your online courses on a schedule. Whether you want to offer cohort courses that start on a specific date, or you want to run dripped courses that can start any time someone joins, it works well.

You can even time your Stripe payments to coincide with content releases.

This works great if you offer payment plans or installment plans for your online courses.

Many people default on their payments, so tying the release of your course content with the end of a payment plan is also a great way to ensure people update their credit cards.

If you’re looking for a Stripe LMS integration then keep reading to see our recommendation!

Creating Recurring Membership Programs

If there’s one thing that business owners love, it’s recurring income that’s predictable.

That’s exactly what you can create in your business if you put together a recurring membership program.

Stripe makes it easy to create recurring billing plans.

However, there are always special situations in a membership where you might need to:

- Pause a subscription for a set amount of time, and then resume a subscription

- Change the date of the next payment, to give the customer time to pay off their credit card for example

- Give a free month or skip a certain amount of payments as a thank you for referring someone to the program

These can be hard to do just out of the box with most Stripe payment integrations.

Luckily, this is where AccessAlly shines and you can do all of the above scenarios right within the Sales tab of AccessAlly.

AccessAlly is a WordPress plugin that lets you take payments through your own customizable order forms.

You can specify taxes by location, and add shipping as needed. To really improve on the tax tracking, you can also use Quaderno to automate tax compliance.

There’s also the added benefit of being able to run your own affiliate program when you choose AccessAlly as your Stripe payment plugin.

Handling Stripe Payments on WordPress

Now that we’ve covered some of the most common use cases for taking payments on Stripe, let’s look at the type of things you need to watch out for.

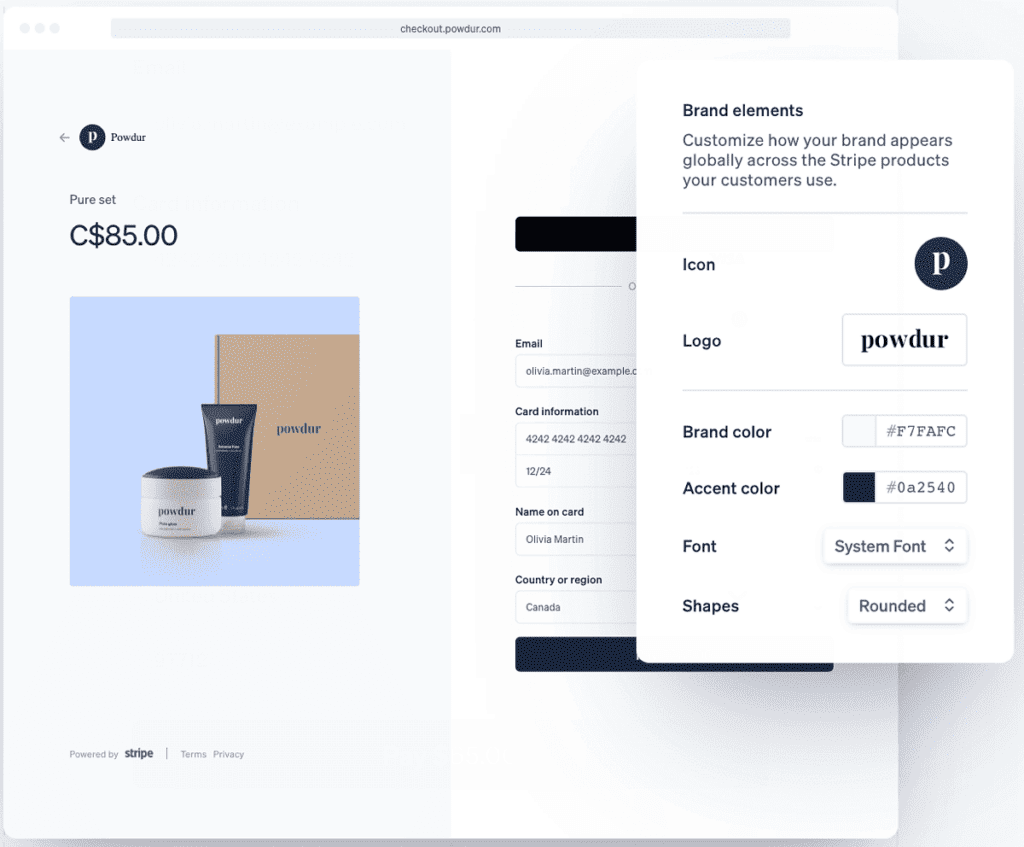

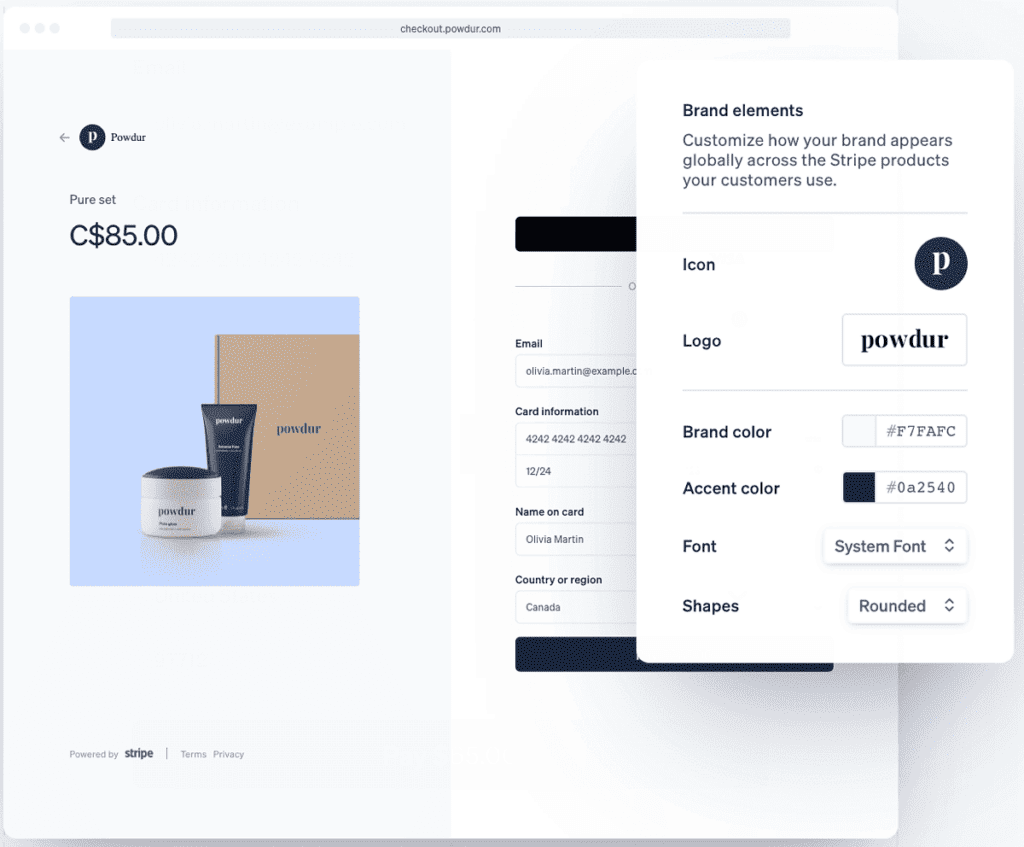

Beautiful and customizable order forms

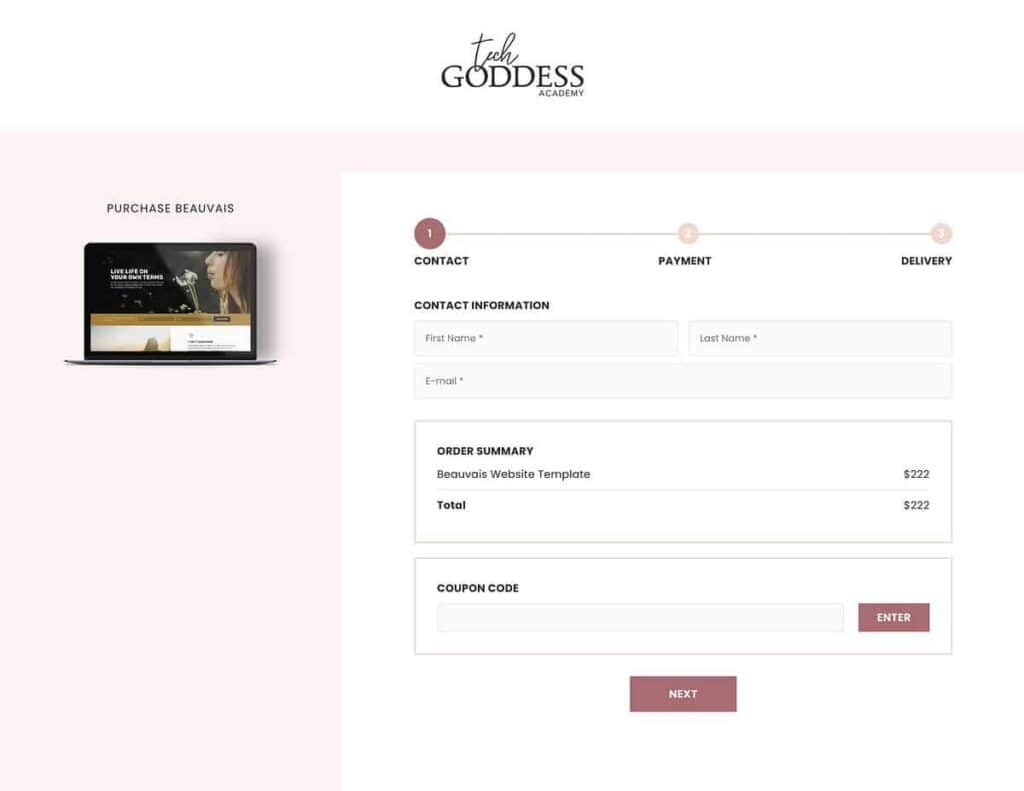

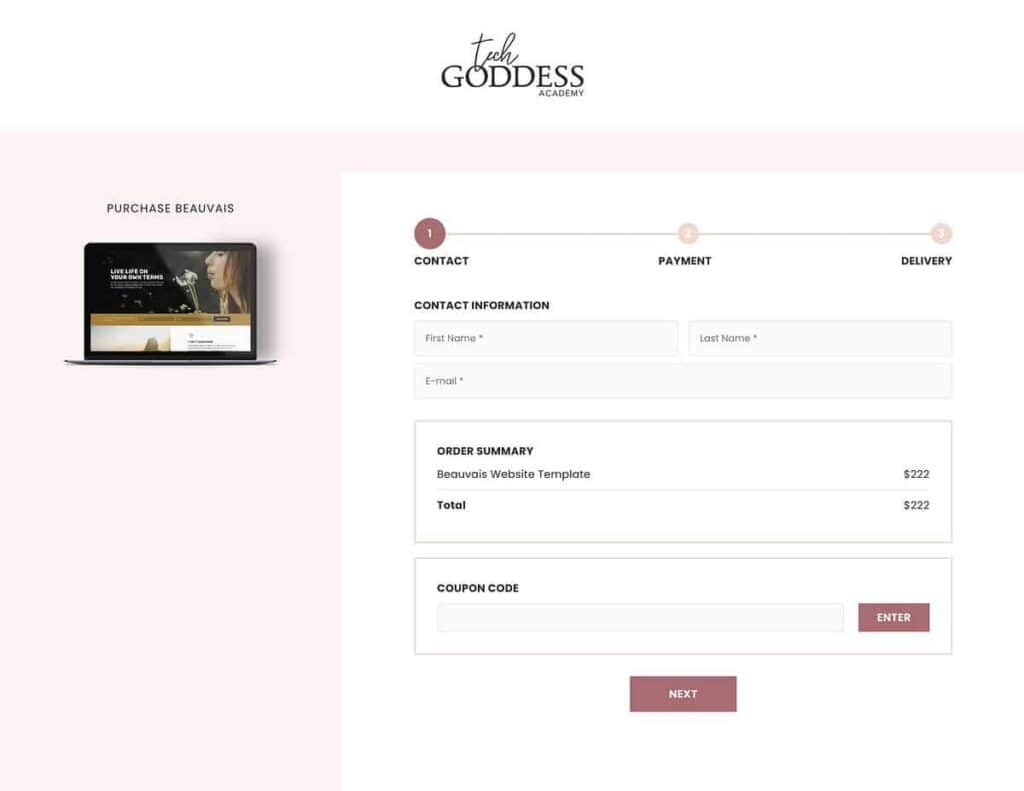

Your order form or checkout form is the place where customers start to enter their payment details.

It’s one of the most important pages on your website because it’s part of the chain of events that lead to sales.

That’s why you want a Stripe order form design that looks professional, works well on mobile devices and can be tweaked to match your branding.

All of these aspects lead to better sales conversions.

But beyond fast-loading, mobile-friendly order pages, you also want to be able to keep in touch with customers or those who abandon their orders.

Abandoned Carts for Stripe Payment Gateway

Did you know that around 75% of all shopping carts online are abandoned?

That means that someone clicks through and decides to order your product or service. But before they complete the checkout form, they back out of the deal.

That’s a lot of potential customers lost.

That’s where an abandoned cart follow-up sequence comes in. You can often recapture a good 20-40% of those lost sales if you send a few extra emails.

But you can’t send any abandoned cart win-back emails if your Stripe order form functionality doesn’t capture the email address before the order is complete.

Unfortunately, the abandoned cart feature is not very common in most other Stripe plugins.

Luckily, AccessAlly has you covered and allows you to create a contact for abandoned carts where you can design your own sequence of follow-up emails to recapture those lost sales.

You can also grab our free template for abandoned cart emails, so you don’t need to write it from scratch. We’ve done all the testing and heavy lifting for you.

Accept Stripe payments with AccessAlly

After you’ve signed up for AccessAlly, you’ll be able to download the plugin. Then login to your WordPress dashboard and upload the plugin under plugin settings.

You’ll be taken through the onboarding wizard, where you’ll enable Stripe and set up any other payment gateways like PayPal.

Once you’ve connected your Stripe account to your WordPress site, you’ll be able to start accepting payments.

The next step is to create your first offering. This could be anything from a downloadable file library to a full-fledged online course or a recurring payments program.

As a Stripe plugin, AccessAlly will automatically create your payment form so you can accept credit card payments immediately.

It also automatically creates a checkout page for you that you can edit the regular WordPress platform way through your theme or builder plugin settings.

Everything is handled automatically through Stripe APIs so you can accept payments securely.

You’ll see all of the payments with stripe inside your AccessAlly sales tab, but you can also login to your Stripe account anytime to see all of the payments and any transaction fees associated with the sales.